When you refinance your mortgage, you're exchanging the current terms of your mortgage for new ones.

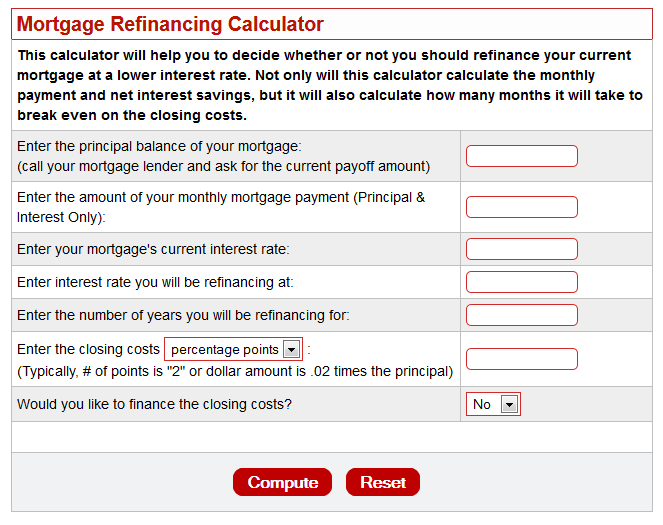

The cost of refinancing averages between 2%-5% of your loan amount, so be sure to add that expense in the “Cost of refinance” section of the refi calculator. You probably wouldn’t want to refinance your loan and then sell your home a year later (before you’ve had a chance to make back the initial cost of refinancing). Maximizing the value of your refinance comes down to timing.īecause out-of-pocket closing costs will set you back at the start of your new loan term, you need to be sure you’ll keep the refinanced mortgage long enough to recoup that initial upfront loss and then benefit from the savings long-term. (Remember that a home loan’s monthly cost is determined by more than just principal and interest-use our mortgage calculator to understand the other costs that can drive up the amount you pay for a home.) But the math of refinancing is a bit more complicated than just pouncing on a lower rate.

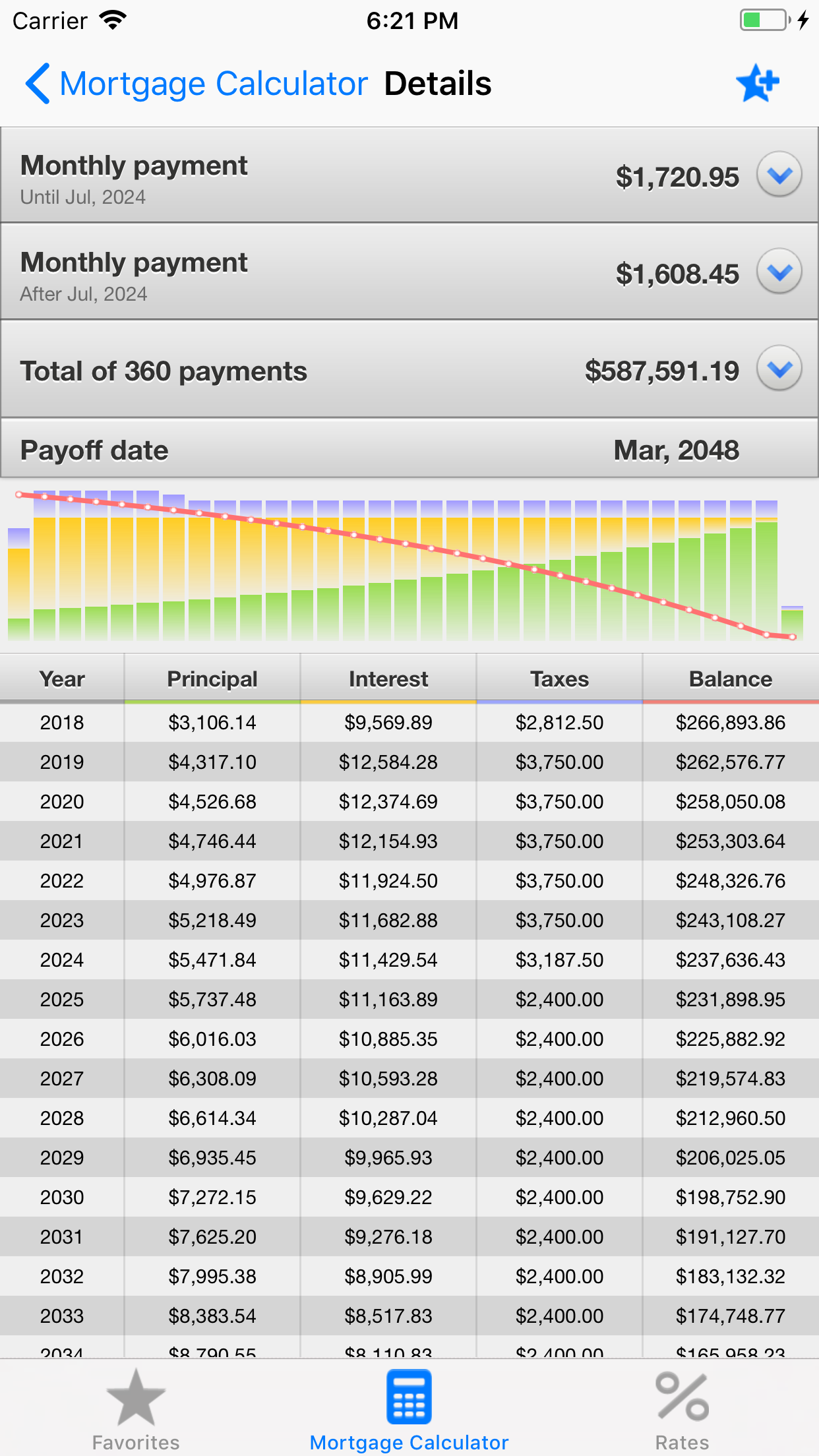

Most people choose to refinance because it allows them to reduce the monthly cost of their mortgage. They will understand your unique financial circumstances and, as experts in the tax code, they can give tailored advice for your situation. If you don’t already know how your tax deductions are filed, speak to your tax professional. Note that the tax rules for cash-out refinances are slightly different, and might limit the deductions you qualify for. The calculator will default to a future and marginal tax rate of 28%, but this figure can be adjusted under the “Advanced Settings” section based on your income bracket and which deductions you expect to claim. Because of this, the calculator figures that you’ll lower your overall marginal tax rate by applying for standard deductions after you refinance. Refinancing can also qualify you for tax deductions-for example, interest payments made on the refinanced loan can be deducted from your overall taxable income. The calculator assumes you will claim tax deductions. If you invest most of your savings in the stock market, increase it to 6%.) (If you keep most of your savings in a bank account, decrease this number to 0%. The calculator applies a conservative estimate of a 3.5% return on your investment, but you can decrease or increase this amount in the “Advanced Settings” section of the calculator. To get a full picture of your maximum potential savings in any refinance scenario, this calculator assumes that you’ll be investing the money you’ve saved-building wealth by putting that extra money toward stocks and bonds. The calculator assumes you will invest your savings. Refinancing can save you money over the life of your loan, and locking in a lower rate is just the first step. Your monthly payment will increase by $18.27.How the mortgage refinance calculator works By refinancing, the total amount of interest paid on your mortgage will increase by $341.51 over the remainder of your term and will increase by $2,521.33 over the full amortization of the mortgage.Your monthly payments would be about $1,645.93 per month, and it would take approximately 26.4 years to pay it down. Your mortgage after refinancing would have a balance of $303,410.04.After applying the refinance penalty to the mortgage balance, you would have $56,589.96 in equity left for debt consolidation purposes.For the exact amount, you must contact your current lender. We estimate that the penalty for breaking your mortgage term early would be approximately $3,410.04.Following federal lending guidelines, up to $60,000.00 of this equity could be available for use during refinancing. You have approximately $150,000.00 of equity in your home.At the same rate, the interest you would pay from now to the end of the amortization would be $215,827.13. It would cost $30,016.26 in interest over the 26 months remaining in your term. Your current mortgage would be paid in full in approximately 26.4 years.

0 kommentar(er)

0 kommentar(er)